The PE CFO Solution Set: Part One

There aren’t enough CFOs with private equity experience to meet demand. Anyone who has tried to hire one is familiar with the shallow existing talent pool.

Instead of rehashing the problem, True’s Private Equity practice wanted to talk solutions. We looked at ways to expand the CFO talent pool - both to help address the near-term squeeze and to craft a long-term solution. The result was this three-part Q&A series.

In this part one, True’s Matt Goldstein and Matt O’Connell break down where and how to find leaders who are “PE CFO material” who haven’t held the role previously. In part two, we explore, with the help of a top PE firm, how to seek out and train PE-CFO-caliber talent already working in the portfolio. In part three, we look at how to support all these newly minted PE CFO leaders to ensure they’re successful once on the job.

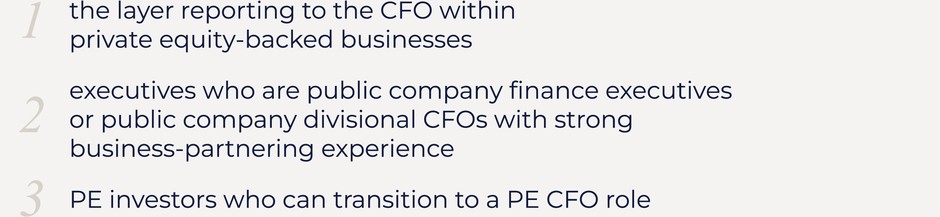

When you're looking to expand the candidate pool, you are doing it in several ways. You are looking at…

There is a different "why" for each group…

Reporting to The PE CFO

This group will already come with an appreciation of the particular operating nuances and focus areas for a finance organization in a PE-backed environment. Failure to efficiently acclimate to the PE operating model is one of the most common pitfalls for net new PE talent, and so this group’s lived experience - albeit at a VP level - provides an invaluable advantage. Assuming they’ve been successful, bring sufficient technical breadth, and were developed under a strong CFO, this cohort’s comparative readiness is high - at least for consideration.

Public Company Finance Leaders

Given the increasing macro focus in public markets on profitability and operational rigor, there are increasing parallels between public company finance work and PE finance work that make this transition more seamless than before. Enterprise or divisional finance leaders, especially those who have a strong business-partnering ability, can potentially translate that skill into serving as the point person between the CEO, the PE investor or investors and the company as a whole.

PE Investors Turned PE Operators

There's a growing trend of PE investors transitioning into CFO roles, attracted by both the compensation and the challenge of operating in a sophisticated PE environment. Oftentimes, this can be a win-win. The investor gains first-hand, operational experience, which can open up a new career trajectory or bolster their skill set should they ultimately go back to investing down the line; and the PE sponsor can mitigate the risk of hiring a first-time CFO by hiring this investor with a deep understanding of the PE operating model and expectations.

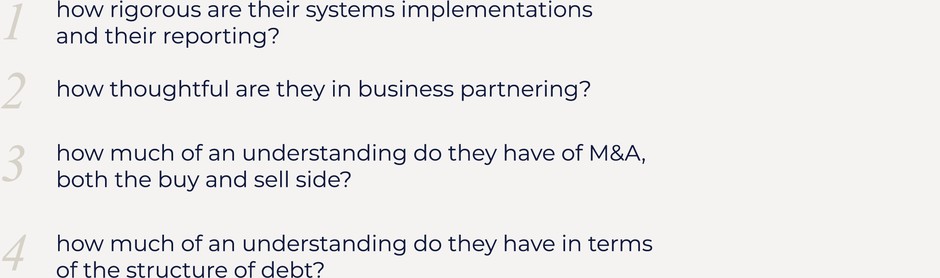

If you're going to take a finance executive from outside the PE arena, you’re going to have to think about specific competencies that might translate in a PE setting. Questions you’ll ask include…

I’d add to that…

We rigorously assess each candidate's suitability using a comprehensive scorecard, tailored interview questions, and by probing for analogous experiences that demonstrate their potential fit for the role. Involving clients in working sessions with candidates has also proven to be very effective, as it gives them a real-time snapshot of not only their technical skills but also how they present and work through problems. By ensuring alignment between the specific candidate competencies (not just experience) and client needs, we're able to collectively build confidence.

You start with a structured scorecard and leverage that across all constituencies (remember there might be multiple sponsors). If the candidate is from one of the aforementioned non-traditional pools, then you start to develop questions that look for comparable experiences to give you confidence that they can take the leap.

reporting to the PE CFO:

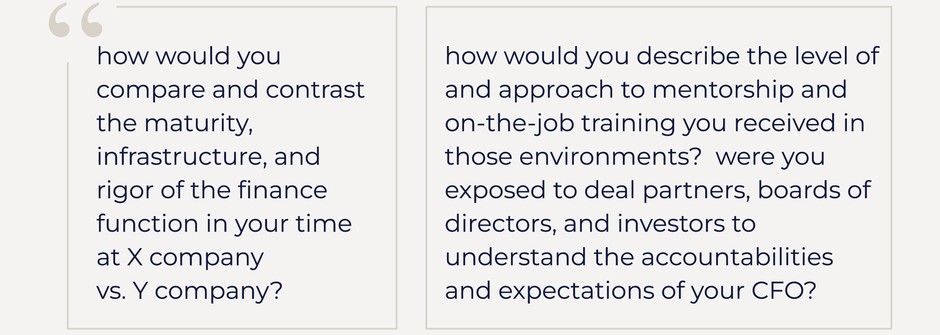

If you’re trying to understand if they’ve trained under "best-in-class" operators and know what good looks like, you might ask them something like,

This would, of course, be bolstered by our knowledge of the ecosystem, companies, players, etc., but it’s important to see the candidate’s critical reflections as well.

Public Company Enterprise or Divisional CFO:

If there’s a roll-up strategy or heavy M&A play to the value creation strategy, you’d want to understand,

If it’s more of a build from the ground and you’re assessing for scrappiness and readiness, you could ask,

Investor-turned-operator:

You have to assess the client situation for the existing leadership and infrastructure. It’s a case-by-case basis of having the client come to an understanding of: ‘Where's my elasticity? And how does that match the candidate pools?’ For example…

If we pick up a VP of Finance who's at scale, what are the competencies that he or she is lacking if they take the PE CFO role? And how do you solve for that and support their growth?

If I have a PE-backed business with little infrastructure on the finance side, it is highly unlikely we’re going to be able to choose the investor-turned-operator candidate. But if the PE firm has a strong infrastructure to be supportive, and the company has a strong number two or controller, then that might open up the door to that investor-type profile.

Even during the pitch process, you're educating the client around this new search strategy and that there are a couple of different “swimlanes,” but now they extend out. And by the way, this is already common knowledge to some of the top PE funds. They know they’re going to have to look at some of these other candidate pools.

It’s also led us to a more expansive approach to the search kickoff. We’re not just looking through the narrow lens of the portfolio company and role requirements, but also spending the upfront time to diligence what alternative candidate strategies are possible by understanding the existing environment and infrastructure that will be there to support them.