What type of leader is needed to drive the AI strategy at a global financial services company?

Institutional financial services companies are actively seeking impactful AI talent to maintain their competitive advantage. Specialized search partners, like True, who have a deep understanding of the tech landscape, play a critical role in making sense of a talent market that is still taking shape. This is happening now and companies are asking questions. Here’s what we have learned so far:

What are global financial services companies using AI for?

As companies rely more on AI for critical operations, the fear of losing market share to AI-powered competitors has become a real concern. Companies have been forced to consider how AI can be utilized and what talent is needed to do this effectively. There is agreement that GenAI and LLMs are needed to enable back-office automation, accelerate productivity gains, foster faster innovation, and maintain and increase market share. There is no agreement across our clients on the best way to deploy AI throughout an organization.

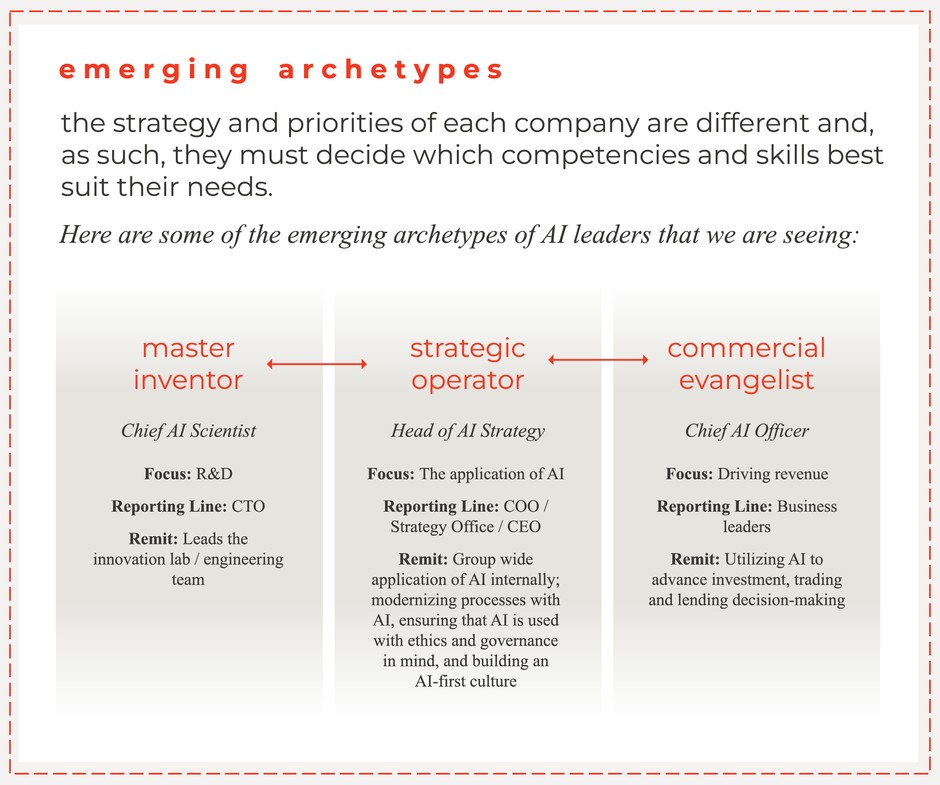

What is the title of this AI leader?

The emerging profile is a Head of AI Strategy. This leader brings deep commercial understanding and can evangelize, collate ideas, and cultivate an environment where the business can drive the flow of use cases. The technology division plays a supporting role, bringing a clear understanding of the data (from a reliability, quality and accuracy perspective) and what is required to build the model the business wants. If the technology division drives the conversation it will likely go in the wrong direction.

Where does this AI leader sit in the business?

There isn’t yet an established model to follow when considering the reporting line for a Head of AI Strategy, and it will take time to effect structural change in large organizations. There is consensus that, wherever positioned, the role must be highly visible and actively sponsored at the level in which the company buys into AI and its application; enabling someone to effectively educate, influence and drive execution. This shouldn't be a vanity hire or a perfunctory “headline” hire; it requires real partnership and sponsorship from someone close to the subject matter.

Is it one hire?

If a company’s objective is to pursue the application of AI internally to improve operational effectiveness, and to invest in R&D for alpha generation, a single hire might not be the right strategy given the differing subject matter expertise, business understanding and technology depth required.

Who in financial services is exploring AI the fastest?

After the big tech firms, it is the hedge funds that are investing in AI research, human capital, and technology to harness AI's potential to find an investing edge. Although there is an agreement at hedge funds that AI is key, there is still huge variation in the type of profile being hired and where this role is positioned. Some firms do not have anyone focused exclusively on AI. Meanwhile, other firms are hiring leaders to build proprietary AI for investment purposes: creating pattern recognition systems to identify and analyze target investments.

Here are anonymized examples of how global financial services companies are approaching AI and structuring AI leadership positions:

At this global banking group Chief Experience Officers (CXO) aligned to each business unit oversee marketing, digital and data efforts, including how AI is used by employees and customers; they work closely with technology and digital teams to drive digital product optimization and utilization across all lines of business. The CXOs from each business unit report into the Group Chief Digital & Chief Marketing Officer.

The Bank has been using AI for many years and there is an established management process in place which enables models to go into production. Examples include the automation of electronic trading, fraud detection and telephony customer experience. There is no longer a Chief Data Officer. The data scientists sit in the CTO organization and work on enterprise solutions, and there are small splinter groups in the business creating bespoke models.

At this global banking group there are two executives leading the AI strategy - a business leader who is the Head of Digital, Innovation and Strategy and a CIO for Digital, Innovation and Strategy. Another key executive is the Head of Strategy who reports into the business Head of Digital Innovation and Strategy; they lead the committee for use cases, act as a conduit between the business and technology, and manage the governance and program management aspect of the AI strategy / application. The efforts around AI are highly collaborative and the structure is continuing to evolve. The Bank’s aspiration is to uplift the entire organization and their strategy has three key areas of focus:

Data quality and completeness - enabling models to produce reliable outcomes, fostering trust and confidence among users.

Engineering team upskilling - to ensure the teams are prepared and able to deliver at the required velocity.

Infrastructure security to ensure affordable modeling utilizing the public cloud.

There is also a new team of former Amazon AI evangelists. They are leading the way from an R&D perspective, but working in a co-contribution model with the infrastructure and security teams who are creating the environment they need to innovate.

At this global banking group there is debate over whether the GenAI / LLM strategy is being led by the technology division or through the data division. There is, however, agreement that the aspiration is to have an AI strategy that is comprehensive and can be driven at an operational level.

There is regular tension between functional business lines on the GenAI approach, but also an evolving recognition that different divisions will have divergent requirements and will need to operate at different speeds. There is an Office of Applied AI which is learning internally (and in conjunction with partners) to build and create value. This team is building products based on the development and commercialization of cutting-edge, responsible and ethical AI-based capabilities for the Global Commercial Bank, Global Banking & Markets, and other lines of business. There is an influential steering committee comprising leaders from Group Data and Data & Messaging (on the business side) and Data & Messaging Technology (on the technology side).

At this global banking group the CEO and CIO have appointed a Chief Data and Analytics Officer who sits on the Operating Committee and has responsibility for data use, governance, and controls. They are tasked with harnessing AI technologies to effectively develop new products, improve productivity, and enhance risk management. Quantum is being prioritized over GenAI and LLMs, from both a time and investment perspective.

At this US headquartered investment bank there is an Office of Applied AI, which operates distinctly from the R&D lab. It is focused on developing ideas that benefit customers, though none of the current projects are client facing. The Bank recognizes the potential business advantage of AI but has been outspoken about the challenges and risks GenAI and LLMs create, and the caution required. Reinforcement learning is receiving significant investment and different values are being explored, particularly around derivatives and execution.

At this US headquartered payments firm, there is a Chief Scientist and Head of Enterprise Data and AI. This person is driving strategy to deliver customer value through AI in areas like fraud detection; utilising GenAI to transform the developer experience; and driving cohesion between product, science, and engineering. They are responsible for the technology strategy, architecture, development of enterprise data, analytics and machine learning initiatives, and advancing the firm’s AI capabilities, tools, and research efforts.

Another key leader is the Head of AI Strategy and Systems for the Cards business, who has identified the key skill-set void as being people who bring both data science and strategy expertise, and is building a team of people who can meet this need i.e. individuals from McKinsey with a PhD.

At this global asset manager the Innovation Officer is responsible for the acceleration of GenAI utilization for client experience, investment profiling and internal processes. The Innovation Officer defines the AI roadmap and strategy and works with functional leaders to create the technical architecture. There is also a central AI Lab coordinating data science efforts and leveraging AI to solve high priority problems across the firm, while driving consistent standards and best practices.

AI leaders will have optimal impact when they can collaborate with other members of the ExCo. This is how existing leaders within financial services companies are adapting to the addition of AI talent in the executive leadership team.

The Chief Data Officer

The role of the Chief Data Officer continues to evolve, as companies know that poor data quality hinders AI adoption and implementation. Data leadership is becoming some of the most sought after talent in financial services as companies are embracing a more data-driven culture. The challenge is that Chief Data Officer roles are not homogenous and the talent pool is becoming more difficult to navigate when also considering the AI-related ambitions of a company.

One key question when hiring an AI leader is what the dynamic will be with the Chief Data Officer and whether, ultimately, the Chief Data Officer will play a ‘check and balance’ role for AI.

Risk and Security leaders

There is consensus on the importance of data, risk and security when considering AI implications for intellectual property, privacy and regulatory compliance. How do you ensure effective oversight to satisfy the Board and Regulators on questions around AI use, mechanics, and whether a company really holds authorization to use the data? How to ensure the AI is not creating excessive risk? Risk leaders will continue to evolve talent in their functions to ensure they have enough technical knowledge to assess and provide effective challenge.

The CIO and CTO

Chief Information Officers and Chief Technology Officers play a critical role in capturing the value of emerging technology for commercial gain, and in embracing AI to enable operational optimization across the technology and operations organization.

However, the technology underpinning an AI strategy is significantly more challenging and different from traditional technology, therefore responsibility for the strategy shouldn’t fall into the remit of the CTO. Instead the CTO is becoming a bridge between the strategic vision and the technical execution, ensuring that the development team is working toward a common goal.