The PE CFO Solution Set: Part Two

This is part two of the True Private Equity Practice’s series on finding solutions to bring more talent into the pool of PE CFOs.

In part one, True’s Matt Goldstein and Matt O’Connell explain where and how to find people who are ‘PE CFO material’ despite not holding the role previously.

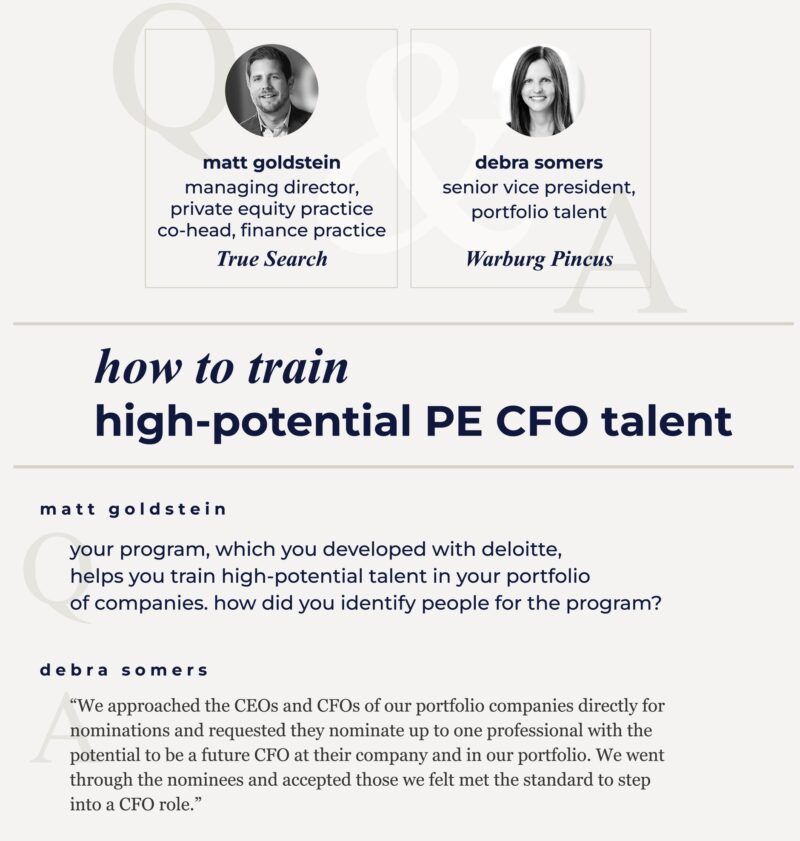

In part two, we look at how to train people to be effective PE CFOs. Matt Goldstein talks with Debra Somers, Senior Vice President of Portfolio Talent at Warburg Pincus, about the Warburg Pincus HiPo: Financial Leaders program. The global PE firm deployed this training in 2022-2023 to identify and develop PE-CFO-caliber talent inside the finance departments of their portfolio companies. Learn more in the conversation below.

What criteria did you use to assess the candidates?

“We accepted the top nominations–those we thought were ready to be a CFO in the next 5 years–and arrived at a group with diverse backgrounds, ranging from 10 to 20-plus years of experience. Most were from FP&A or Finance, and there were also a good number of Controllers and VPs of Corporate Development.”

Wouldn’t this talent develop on its own if it’s already in PE companies working under PE CFOs? Why invest in this training?

“There is a steep learning curve for CFOs, especially in private equity and venture-backed companies, which is often the reason leaders in these companies don’t want to hire step-ups. Without training, you are also counting on the idea that CFOs will invest in a succession plan, which doesn’t always happen. Finally, one of the significant benefits of this program is the Warburg High Potential CFO community. The participants act as resources and help each other.”

Are you looking to develop a new kind of PE CFO with these training programs? How are they different from traditional PE CFO?

“I think the CFO role has expanded significantly from the traditional CFO. There is a lot written about this in the press. This is consistent with the trend you hear of the shift from the Controller CFO to the FP&A CFO with a strong Controller under them—the new, ‘what will happen in two years?’ mentality versus the old ‘what happened last quarter?’”

What has been the ROI on the program? Any big success stories?

“We just had our first HiPo conversion to CFO at our portfolio company, Bond Vet. He was the number two at our company Summit Health which includes CityMD in the urgent care space. Summit Health has grown into a large company, but it wasn’t when we bought it. The number two was very well-regarded by the CFO, and he really impressed us at our HiPo program. Bond Vet is a smaller, but quickly-growing, pet urgent care company headquartered in New York City and the CFO is an excellent fit.”

“We’re looking at converting at least two other HiPo’s right now, one as a promotion within his company and one into another portfolio company. We are actively considering more for upcoming CFO searches. There were 46 participants in our pilot program so we expect more conversions, though many will happen over time. If we convert even a small percentage of those to CFOs, it will be more than worth it.”

This is a huge investment. How do you justify this expenditure to your leadership? Is this type of program adaptable to a smaller company and would it be worth it?

“I think the key barriers to entry are time and cost. A regular CFO search will cost about $150,000-250,000. Even producing a few future CFOs from a program like ours will more than pay for itself, not to mention the retention potential for our portfolio and the development potential for the participants. It’s about making the investment in those individuals and tailoring a curriculum for their success in our portfolio.

Within our portfolio companies, we want to assist the C-suite with optimal succession planning, and our priority for them is leverage and retention. But if the current CFO is continuing to perform well, why not try to find another opportunity within our portfolio for their HiPo who is ready for the CFO role?”

Are you expanding the high-potential program to any other function or roles? Are you still doing the CFO program?

“We started with the role of CFO because it tends to be the foremost position we replace, and according to research, it is generally the most replaced private equity position. We want to keep the bar very high, so we plan to do the program every two years for CFOs. In 2024 we are hosting our first HiPo program for Technology leaders. Participants include C-1 and 2 roles such as VP Engineering, VP Product, and VP IT. Session 1 took place in May and session 2 will be in late July. We will continue to think about expanding the program to other transferable roles in the coming years. We are committed to making the program as successful as we can.”