The modern Chief Financial Officer actively shapes corporate strategy, manages risk, and drives long-term enterprise value. They navigate complexity, challenge the status quo, and serve as the CEO’s co-pilot in a constantly changing landscape.

CFO influence now spans capital allocation, M&A, operational efficiency, and digital transformation. Today’s CFO has a hybrid skill set: deep financial acumen, strategic foresight, digital literacy, and exceptional leadership.

This structural transformation requires a new talent playbook. Organizations must widen the lens through which they view top financial talent and where they look for their next CFO.

Trends Affecting the Top Finance Role

At True’s Finance Practice, we are seeing a fundamental rewiring of the CFO’s role, the talent market, and the very definition of a top candidate.

The Modern Finance Skillset

Today’s finance chiefs must manage more than capital. They must be cross-functional business partners who operate seamlessly alongside go-to-market, product, and technical teams. Many of today’s strongest CFO candidates come from investing or banking backgrounds, and also increasingly from private equity, venture capital, corporate development, and even Chief of Staff roles. These individuals have the commercial discipline and market fluency they need to scale complex organizations, particularly those at the intersection of finance and innovation, like AI-driven businesses. A product-oriented, technically fluent, and data-savvy mindset is now a baseline expectation.

The Scale vs. Fit Dilemma

Early-stage, high-growth companies often face a unique challenge. They need Heads of Finance and CFOs with experience in scaling, yet these same leaders can find it difficult to adapt to unstructured environments. This is particularly evident in many AI companies, which are rapidly growing from zero to hundreds of millions in revenue with fewer than 100 employees. This cultural mismatch represents a significant dilemma in the current talent landscape.

Building the Internal Pipeline

While the external talent market tightens, many organizations are turning inward. Forward-looking companies are investing in development and succession planning at a level below the C-suite, focusing on its Vice Presidents of Finance and Divisional CFOs. By cultivating this internal talent, they ensure continuity and create a sustainable pipeline of finance leaders who can step up as the business evolves.

“Underwater” Equity and Market Reset

Executives who joined PE-backed companies at peak valuations now face “underwater” equity due to a difficult and delayed exit environment. However, new PE platform investments at more rational valuations offer incoming executives a clear path to meaningful wealth creation. This market reset is creating attractive opportunities, motivating CFOs with diminished equity upside to seek new roles based on healthier fundamentals.

To attract top CFOs, today’s investors must demonstrate a rational path to value creation. They need to proactively “right-size” equity or offer transaction bonuses to bridge the gap and keep leadership engaged through longer hold periods by acknowledging these changed circumstances.

The Death of the Remote CFO

There is a strong and growing expectation for senior leaders to be physically present at the workplace. Boards and CEOs now view the CFO as a critical “cultural anchor” and their physical presence is deemed essential for driving accountability, fostering collaboration, and mentoring the next generation of finance talent. The era of the remote CFO is now in the past.

The Dual Role of the CFO / COO in Consumer Businesses

The roles of CFO and COO are formally blending in consumer businesses. Recent supply chain disruptions highlighted the need for operational leaders with financial expertise, as traditional COOs often lacked the necessary skills for issues like managing tech debt and improving margins.

As a result, many companies now seek a single leader to apply a financial lens to operational decisions. True has placed hybrid CFO/COO roles even in smaller companies (revenue >$100M). These leaders typically spend 20-40% of their time on COO duties.

We see three implications of this trend:

- Demand for this dual role has dramatically accelerated recently and is creating a challenging hiring market, as the pool of talent with proven experience is still very small.

- It has made the CFO role a natural stepping stone to COO. True placed prior CFOs in 40.5% of its global COO placements this year.

- AI further broadens the CFO’s scope to include data-driven decision-making and automation, making the CFO position a logical path to CEO—a once unheard of career trajectory—undeniably linking the top finance role to succession planning.

Creative Solutions to Remedy the Talent Crunch

As market needs and the CFO role evolves, a significant challenge arises: a shrinking pool of proven financial leaders. The supply of “bullseye” candidates who previously held the same role at a similar scale is now extremely limited.

This talent shortage compels companies, particularly within the demanding private equity environment, to abandon rigid candidate archetypes and adopt more creative and flexible talent strategies.

Prioritizing Potential Over Perfect Resumes

Hiring managers now prioritize a candidate’s potential over a perfect resume or long tenure at large firms. Given rapid technological change, our clients favor CFO candidates who have adapted and thrived in complex environments, valuing strategic aptitude, speed of learning, and ability to operate at scale over knowing a single “playbook.” This shift is prominent in high-growth and tech sectors, where analytical rigor and first-principles thinking outweigh traditional industry experience.

Expanding the Definition of the CFO

The modern market has embraced several new archetypes that reflect this new outlook. What unites these profiles is a proven capacity to adapt quickly, think strategically, and drive impact across functions. This is also a clear sign that organizations are redefining what “qualified” looks like.

- The Step-Up Candidate: Often a Divisional CFO or VP of Finance stepping into the top role for the first time. These leaders may come from the same industry or pivot from an adjacent one, bringing fresh perspectives and operational readiness. 26% of True’s successful CFO placements this year were first-time CFOs.

- The Scale-Up Candidate: A sitting CFO from a smaller organization who takes on a significantly larger mandate, such as moving from a $150 million business to a $300 million platform. Their experience scaling systems and teams can translate well to a new level of complexity, particularly when they bring strong domain expertise and industry knowledge.

- The Investor-as-Operator: An emerging profile, this leader transitions from a PE, VC, or banking background into a portfolio company’s CFO role. In certain cases, it may be an investment they led, and/or a company where they have sat on the board. Having analyzed hundreds of businesses from an investor’s lens, they bring a deep understanding of value creation, capital allocation, and stakeholder management that align closely with the growth ambitions of high-performing companies.

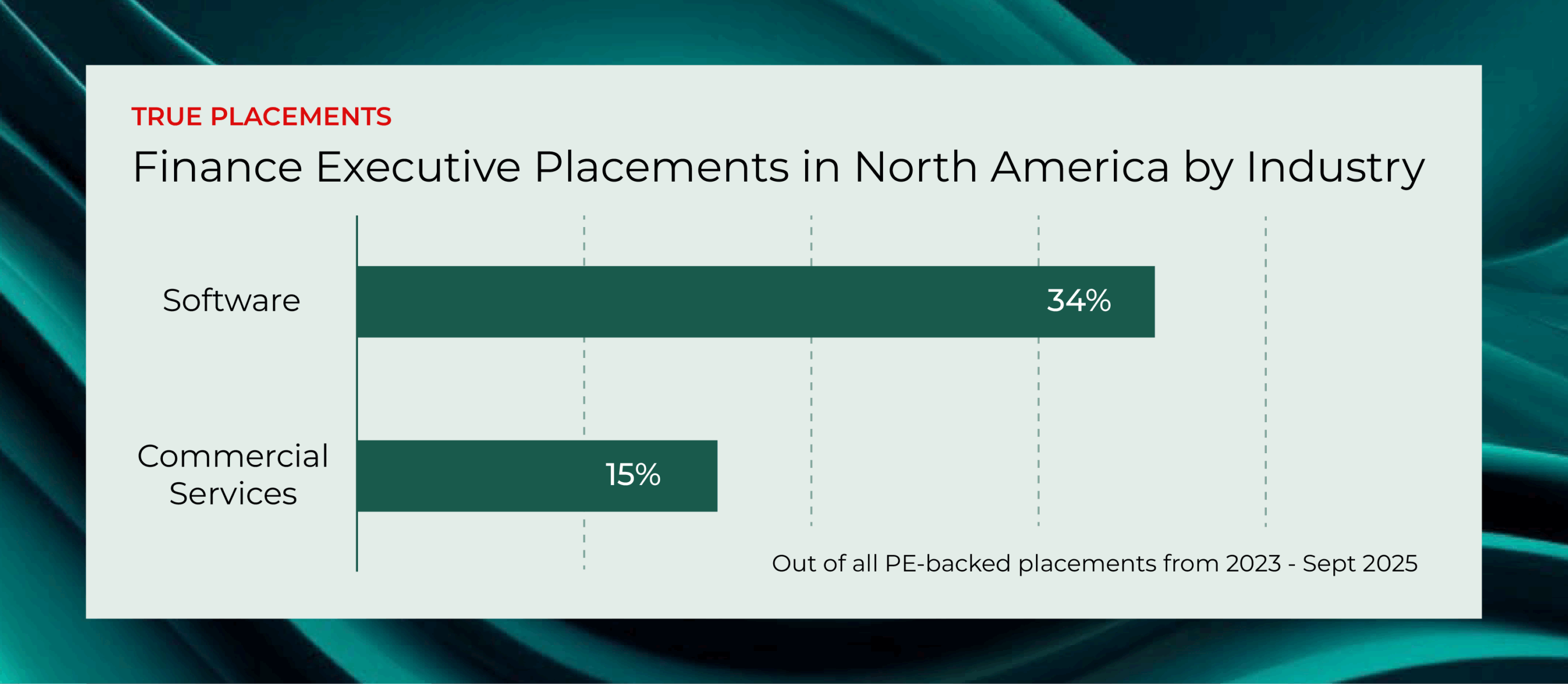

Cross-Asset Class Mobility

The ideal finance leader now has to be proficient in both rapid growth and disciplined efficiency as the skillsets required in VC and PE ecosystems have become more aligned. The VC market in the U.S. has matured and moved away from a “growth-at-all-costs” mentality and the focus has shifted more toward profitability and operational rigor. This new environment now highly values the disciplined, bottom-line-oriented approach of a PE-trained CFO. True has placed multiple CFOs with PE backgrounds in VC-backed companies, 34% of whom went to software, and 15% to commercial services.

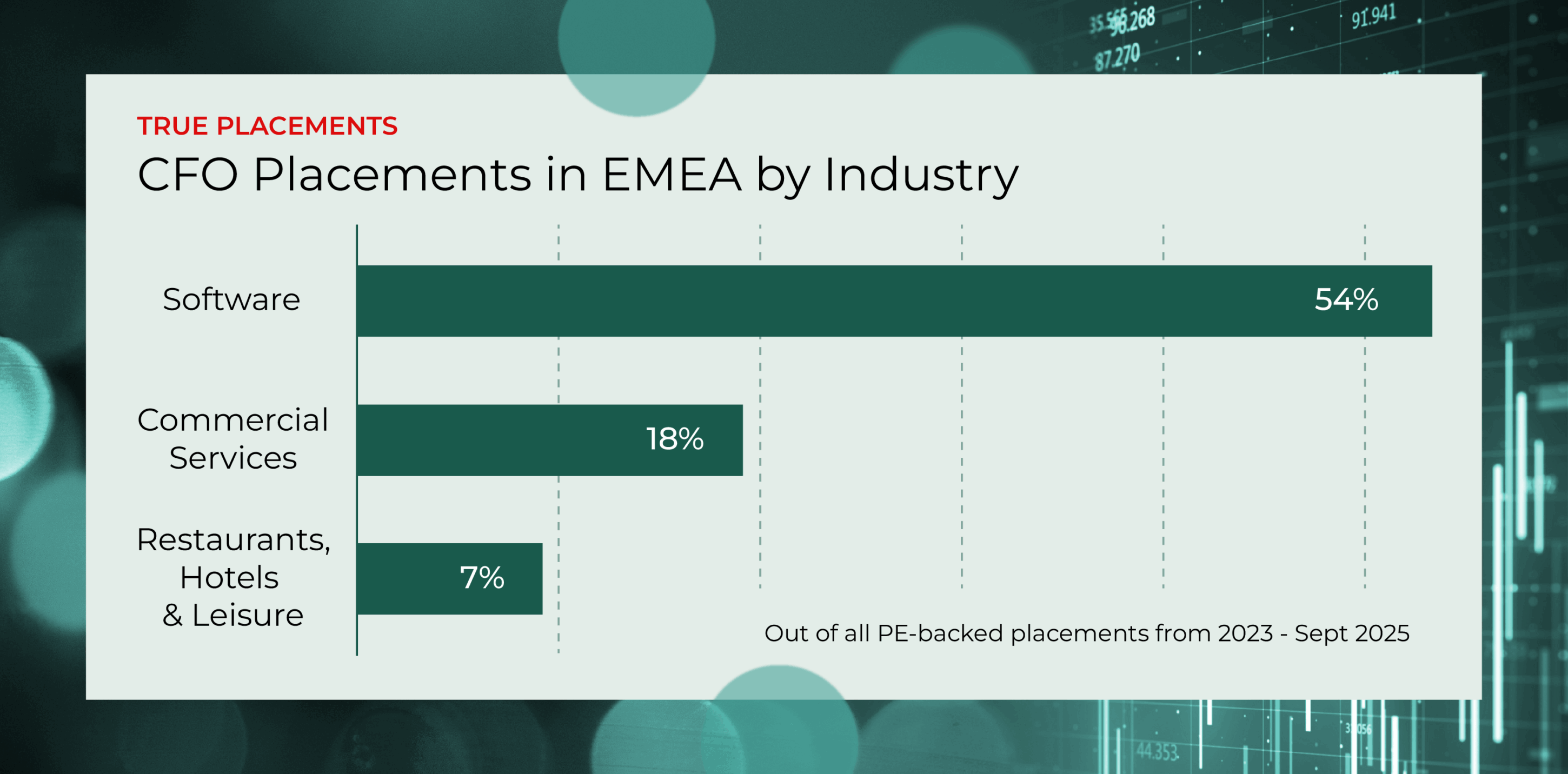

On the other hand, a talent shortage within the PE ecosystem in Europe is making it increasingly common for PE funds to recruit CFOs from VC-backed companies. A VC CFO who has successfully navigated the recent market downturn, managed cash burn, and steered a company toward profitability has demonstrated precisely the operational resilience and financial discipline that PE sponsors covet.

The Transatlantic CFO

North America’s abundance of high-growth, scaled companies has created a strong pool of finance leaders. European investors actively seek access to this larger, more mature US talent pool. While few North American candidates once considered a move to Europe, many we speak to now express genuine interest. True has placed multiple North American CFOs in senior European roles just in the past year, and 54% of them were in the software industry, followed by 18% in commercial services and 7% in restaurants, hotels and leisure.

What’s Next:

The CFO as Digital Architect and Change Agent

With expanded operational and strategic duties, the CFO now owns the company’s data and automation agenda. Finance leaders will use AI to enable real-time insights, build dynamic scenario planning models, and set up more efficient AI-assisted operations.

The most forward-thinking executives will make finance the platform for company-wide AI adoption. CFOs are beginning to sponsor automation and AI investments not just for cost-cutting, but to unlock superior speed and quality in decision-making.

This vision, however, faces some challenges. Many scale-ups lack the integrated data architecture required to deploy AI tools, forcing an incoming CFO to first rationalize a fragmented tech stack of ERP, BI, and CRM systems. There’s also a pronounced scarcity of AI-savvy finance leaders, a talent gap that appears particularly acute in Europe where we have not seen as many ideal candidates.

As technology infuses every aspect of the business, we are also seeing rising demand for leaders fluent in both hardware and software. High-growth, complex sectors like defence tech, climate tech, and industrial innovation are driving this trend.

Ultimately, the new role of today’s CFO is not just limited to finance, and instead encompasses driving the strategic, operational, and digital value of the entire enterprise.

AUTHORS

Maëlys Herbère-Mogck

Managing Director, Head of the Finance Practice

.

Aaron Rouza

Managing Director, Head of the Finance Practice

.

Hal Stoddart

Managing Director, Head of the Finance Practice

.

Vanessa Vercollone

Managing Director, Head of the Finance Practice

.

Rhoda Longhenry

Managing Director, Head of the Venture Capital Practice

For media inquiries, contact Jillian Ruggieri