Listen to the audio version of this article.

We previously highlighted that we’ve seen increased demand for CEO searches— True has seen a +26% uptick in search volumes YoY. We’ve since conducted an analysis to understand the implications of this trend on the CEO appointments that followed.

Founder CEO succession in the VC market has often been solved with step-up CEO candidates, which we define as executives taking a CEO role for the first time. That rate has been stable for several years at circa 50%.

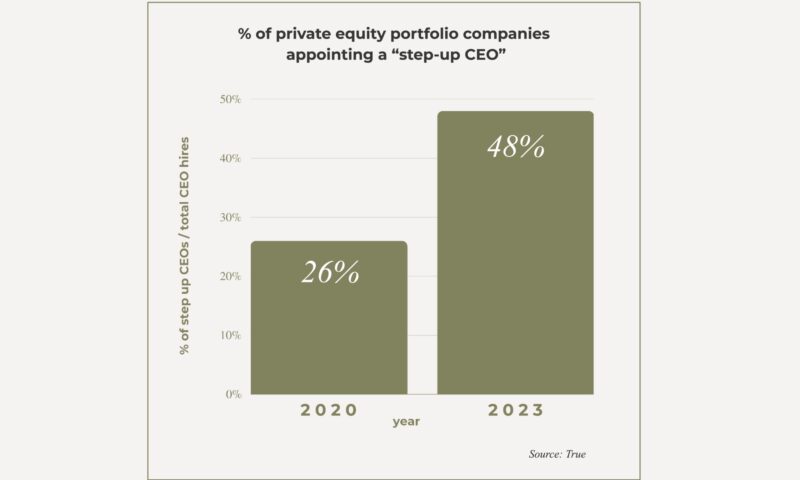

If we turn to private equity, our data shows that historically it was the opposite with PE-backed portfolio businesses: PE investors would typically wait for an experienced CEO to take the helm of the business. In the last four years, however, our data shows that the percentage of step-up CEOs successfully appointed to run PE-backed companies has gone from 26% to 48%.

There are three themes that we see driving this change:

Listen to the audio version.

Want to get in touch? caroline.lo@truesearch.com