WITH INSIGHTS FROM

Evan Grossman

Managing Director, Head of the CEO and Board Practices

.

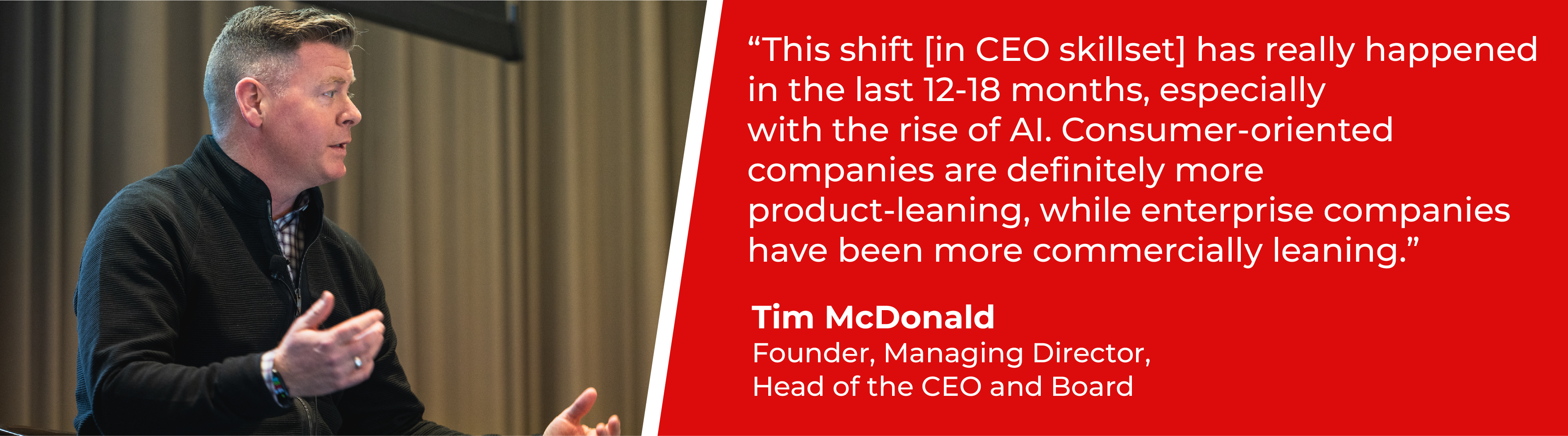

Tim McDonald

Founder, Managing Director, Head of the CEO and Board Practices

.

Caroline Lo

Managing Director, Head of the CEO, Board and Financial Services Practices

The selection and/or transition of a CEO is a defining moment for any company. The stakes are high, as the outcome can drastically affect financial performance, investor trust, employee engagement, and customer relationships. Several forces complicate CEO transitions. Continuing market volatility creates unease, forcing any leadership shift under a brighter light. Fierce competition means even subtle signs of a change can be exploited. Today’s stakeholders also expect greater transparency and accountability, closely examining all leadership decisions.

In this environment, a well-managed CEO transition becomes a critical advantage. Effective succession not only ensures leadership continuity but can also introduce new perspectives, foster innovation, and project stability to the market. A poorly handled transition on the other hand, can create uncertainty, internal conflict, and lost momentum, potentially jeopardizing even the most promising businesses.

Using insights from True’s proprietary data and observations from our experts in the CEO and Board Practices, we delve into how these market forces influence our CEO search and placement strategies in 2025.

Shifting CEO market

The demand for CEOs continues to surge but the qualities and expectations for these leaders have significantly evolved. Companies now require more from their CEOs, reflecting a need for a broader skillset. At True, we have seen several trends contributing to this shift:

Founder burnout | The intense pressures of the pandemic, followed by a boom, then economic downturns in 2023 and 2025 have led to significant burnout among founders. Even those who have maintained their positions are choosing to transition out.

Shift to profitability | Companies that were previously focused on pure growth are now also prioritizing long-term profitability. Founders who lack the skills for this new direction are being replaced by seasoned CEOs with relevant experience.

Self-awareness | Some founders recognize that their skillset is no longer the best fit to lead the company in its current stage of development and are proactively stepping down.

Evolution of CEO roles in PE | Previously, a PE-backed company would bring in a CEO focused on bottom-line results and strategic planning to facilitate a sale. Given lengthy hold periods in this market and broader technological trends, current owners are increasingly hiring new CEOs mid-hold. “With longer holds, a new CEO may be needed to refocus on product and strategy, reacceleration of growth, and potential reinvestment strategies designed to make the asset more attractive for a future sale,” says Evan Grossman, Managing Director, Head of the CEO and Board Practices. “This creates more CEO opportunities as companies pivot to accommodate a longer hold.”

Desire for fresh perspective | Even without dramatic underperformance, private equity firms may sometimes seek a new CEO simply to bring a fresh perspective and talent to the business.

Less transaction activity | By the end of 2024, over 30% of PE-backed companies had been held for at least five years, the longest in a decade, according to PitchBook’s Q1 2025 Quantitative Perspectives: US Market Insights report. Longer hold periods require a different type of CEO.

Performance scrutiny | With longer hold times, private equity firms are more intensely evaluating the performance of their portfolio companies and the effectiveness of the current CEOs. This leads to more replacements of CEOs who are not meeting changing expectations.

Need for operational expertise | The focus has shifted from pure growth to include profitability, requiring CEOs with strong operational skills, efficiency focus (including potential headcount reductions and automation), and the ability to reorient the business.

Increased scrutiny | Companies appear to be more willing to make CEO changes if performance doesn’t meet the evolving demands of the market.

Retirements | Many long-tenured and highly regarded CEOs are retiring, creating vacancies at the top.

“Done” sentiment | The pool of available CEO talent is shrinking as some CEOs who have achieved significant financial success through IPOs or acquisitions in recent years are opting to retire or pursue other interests rather than taking on another CEO role. They are choosing to build diverse portfolio careers earlier than previous generations of leaders, combining public and private boards, operating partner roles, personal investing, and advisory mandates. This also allows them to explore new markets or support causes they are passionate about.

A new kind of CEO

To successfully navigate these challenges, today’s CEOs need a different set of skills than they did in the past. CEOs must also adapt to remain in their roles longer, effectively inspiring their workforce and satisfying stakeholders. With a greater emphasis on operational excellence and sustained profitability than before, companies are increasingly exploring the “hidden” potential of executives with relevant skills to take on the top role.

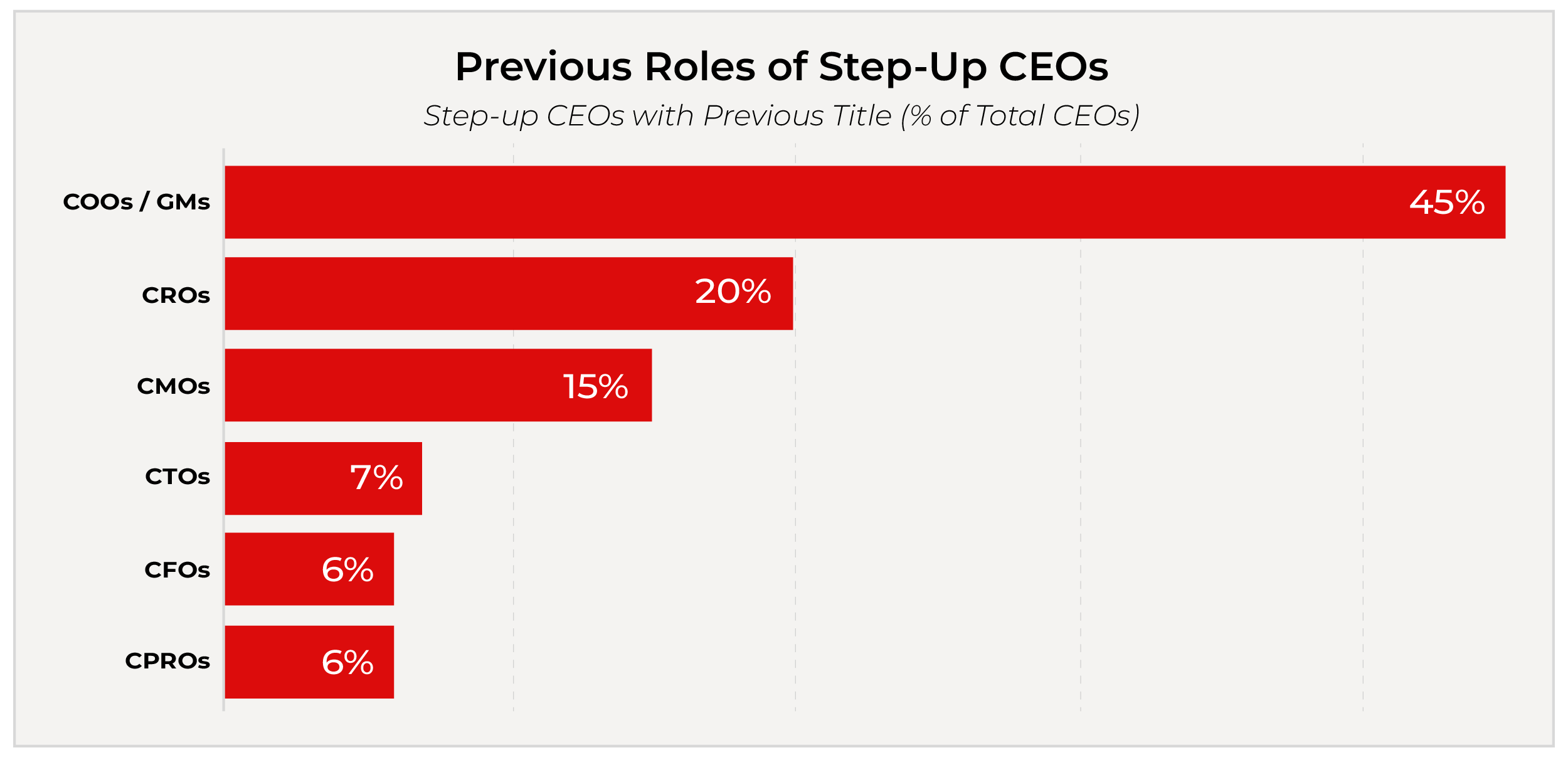

Our data reveals a growing willingness to appoint first-time CEOs, particularly those with operations or general management backgrounds, highlighting the importance of corporate agility and strategic reorientation. This is further evidenced by the popularity of executives with experience in value capture, as go-to-market centric leaders take the helm as CEO.

“This shift has really happened in the last 12-18 months, especially with the rise of AI,” adds Tim McDonald, Founder, Managing Director, Head of the CEO and Board Practices. “Consumer-oriented companies are definitely more product-leaning, while enterprise companies have been more commercially leaning.”

Strategic moves

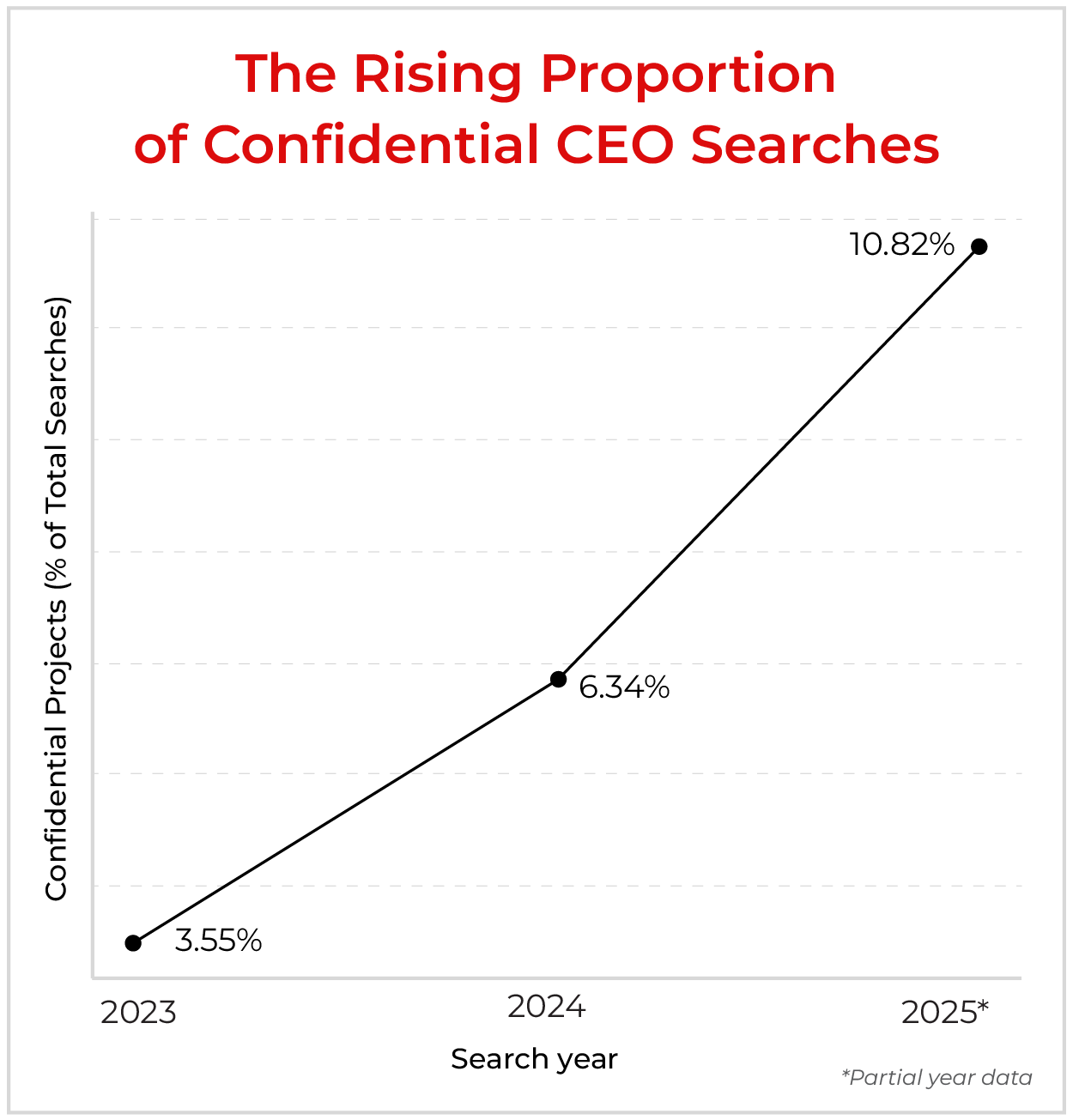

True’s recent CEO search trends also show a significant increase in confidential mapping projects relative to the total number of CEO searches. “There’s a growing trend among our clients to think ahead and invest more in succession planning,” observes Caroline Lo, Managing Director, Head of the CEO, Board and Financial Services Practices. “We are helping more clients quietly decide if it makes sense to replace their CEO, and understand both internal and external candidates for succession.”

What confidentiality means for CEO search

- Investors planning ahead | Similar to public markets, the search for potential CEOs begins long before a change is anticipated.

- Increased sensitivity around CEO departures | Companies are becoming increasingly sensitive about announcing CEO changes publicly before a successor is secured. This could be due to concerns about stock price volatility, maintaining business continuity, employee morale, or competitive intelligence.

- Competitive business landscape | Companies might want to keep their leadership changes confidential to avoid alerting rivals to their strategies or potential vulnerabilities.

- Economic uncertainty | Today’s economic volatility and uncertainty can lead to more frequent leadership changes and companies might prefer confidentiality to avoid creating further instability or negative perceptions.

These trends combined, especially the unpredictable economic environment coupled with uneven AI adoption across industries and business functions, is reshaping the essential skills required of today’s CEOs. The focus is moving away from pure growth towards a greater emphasis on long-term profitability, technological competence, and effective product strategy.

Summary

Leaders of True’s CEO and Board Practices note these key market trends that affect how we find and place CEOs today:

- Shifting CEO skillset: Top line-oriented CEOs who have primarily focused on driving revenue at the expense of operational rigor, profitability, and transformation are being replaced in favor of leaders with more expertise in product strategy, technology transformation, and modern revenue generation.

- High demand, low supply: Market trends are creating a high demand for experienced and capable CEOs across all sectors, while the supply of individuals eager and qualified for these roles is relatively low.

- First-time CEOs on the rise: More first-time CEOs are stepping into the top role, particularly in companies undergoing a large tech, product and/or go-to-market transformation.

- Record CEO searches: The volume of CEO searches has reached unprecedented levels, with significant year-over-year growth.

- Confidentiality matters: A rising proportion of CEO searches are being conducted confidentially, indicating increased sensitivity and strategic moves.

- Compensation trends: Total CEO compensation, including base and equity packages, continues its upward trend. This reflects the high demand for CEOs in a competitive market, the need for proven CEO talent including agile leadership capabilities, capacity for a broader scope of responsibilities, and candidates’ desire to maximize their compensation for strong performance.

Looking ahead

Navigating today’s market for CEOs requires strategy and expert insight. The trends we’ve outlined here—shifting skillsets, the emergence of first-time CEOs, and confidentiality—speak to a significant evolution in leadership dynamics. Finding the right CEO has never been more vital to ensuring an organization’s success, stability, and growth potential. With our extensive data, deep market knowledge, and unparalleled network, True can help guide your organization through every step of the CEO search process. To dig deeper into the trends presented in this article—and turn market challenges into strategic advantages—please contact our team.

For media inquiries, contact Jillian Ruggieri