SaaS companies want people who know usage-based pricing and product-led growth

Not a day goes by without someone asking veteran SaaS recruiter Pat Haggerty some version of this question: ‘Do you have anyone with experience in usage-based pricing and product-led growth?’

B2B SaaS companies are increasingly abandoning the traditional subscription model in favor of usage-based pricing models, where the customer’s product utilization directly influences how much they pay. For many companies, usage-based pricing goes hand-in-hand with product-led growth, an end-user focused model where the software itself drives customer and company success.

As more True clients across North America, Europe and Asia are making the software switch, they’re feeling the challenges of hiring from the relatively small pool of SaaS executives currently working in this trend.

Our Enterprise practice works with the investors, founders and executives building the future of software. Here’s what they all say about how to hire—and be hired—for these increasingly valuable product-led growth and usage-based pricing roles.

Usage-based pricing is going mainstream

VC growth firm OpenView surveyed nearly 600 SaaS companies across the globe in their 2021 Usage-Based Pricing Report to find out how they price their products. Forty-five percent of SaaS companies had a usage-based model in 2021, and OpenView forecasts that number will jump to 56 percent in 2022. Sixty-one percent of software companies that do not have a usage-based pricing model right now plan to use it, test it, or introduce it in the future.

It’s popular because it’s good for business, explains OpenView operating partner Kyle Poyar. Software companies with usage-based pricing experienced faster net expansion and continued growth at scale. Seven of nine public companies with the best net dollar retention in recent years fit the profile, including Elastic, Snowflake and Slack.

“Usage-based pricing is going to make businesses stronger, because they’re going to be more customer friendly and will watch closely how successful their customers are with their products,” Poyar said.

And those stronger businesses have better returns for their investors. While revenue may not be as predictable as in subscription-based pricing, this model does lead to significantly higher multiples than the median for other public cloud companies.

Previous experience not required

As more companies shift towards these models, investors and founders are looking for talent that have made the transition. But like many new trends, the pool of people with previous experience is small.

Founders and clients can get stuck thinking they need a candidate from a particular company. True’s international practices often get requests for talent from Datadog, Figma, Docusign or Elastic. David Winch, co-Head of the Enterprise international practice says that thinking puts clients at a disadvantage.

“People trap themselves into thinking they need product-led growth experience, but you can’t rely on your ability to hire people with previous experience, ” he said. “You need to hire people outside of this small talent pool to scale your business.”

Look for competencies

Clients and candidates need to know: Executives don’t necessarily need direct experience; they just need to have certain transferable skills.

“When talking to a founder, candidates should show where they’ve built customer communities, how they are close to product, how they’ve created use cases, and how they bring a customer lifecycle approach to impact growth beyond acquisition, into activation and expansion,” Winch said.

As an example, sales leaders need to prove that they can create use cases to land and expand the product in more places. For marketing, the candidate must show an ability to augment product-led growth with data-driven demand generation and growth marketing. The great news is, all these skills exist in highly-qualified candidates outside of existing product-led growth/usage-based pricing companies.

True client Supermetrics has done this well. As one of Europe’s most successful product-led growth businesses, Supermetrics’ decision to invite CMO Gabrielle Stafford from Groupon wouldn’t have been an immediately logical choice. Stafford didn’t come from a product-led growth SaaS logo, but she did bring deep experience building and leading a demand gen/performance marketing machine with strong community, high velocity and product focus. Today, she’s having a profound impact as Supermetrics continues to grow at pace.

Irena Goldenberg, general partner at Highland Europe, is on the board of Supermetrics and WeTransfer. She says that while not enough talent has used this product-led growth playbook, there are excellent candidates like Stafford who have the right understanding of how to use customer data to be successful.

“I think what is critical to this model’s success, and where there is a pool of talent in Europe and the US, are very data-driven marketers,” Goldenberg said. “They could be coming from gaming; they could be coming—like Gabrielle—from a Groupon, which was meticulous about attribution, conversion and profitable return on marketing investments. Those marketers can adapt to another data-driven model.”

How expectations change for executives across functions

It’s clear this growing preference for usage-based pricing means a change in how executives think about their customers and the talent they hire. Delivering for the customer to boost their engagement becomes the focus of every role in a software company. The impacts are wide-ranging and affect all functions. To be able to market themselves, executives need to understand how expectations are evolving.

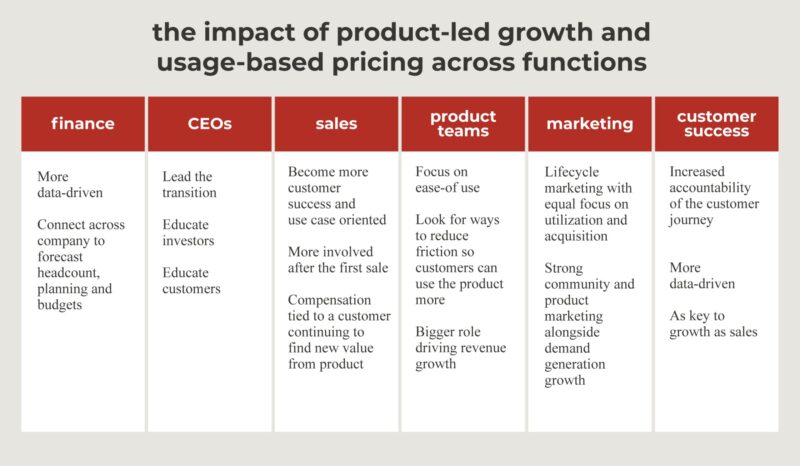

CEOs

CEOs will need to display strong leadership to successfully drive a transition to usage-based pricing. Company leaders must educate their investors on the business model and the new metrics to evaluate it. “It can be challenging to get investors comfortable with a model that’s less predictable, even if it has more upside,” said Poyar.

Finance

With usage-based pricing it will be harder to predict revenue because customers aren’t locked into predictable agreements. Revenue can also fluctuate seasonally. Finance has to be even more data-driven in order to forecast revenue growth, overall headcount and budgets. Their relationship with sales, marketing and customer success will be closer. “Finance executives will need to be able to take a more horizontal and cross-functional view of their businesses than ever before,” Haggerty said.

Marketing

With subscription-based models, some businesses would focus more on the point of acquisition. But with usage-based pricing, marketers must focus more energy on lifecycle marketing. They are driving utilization in close partnership with sales and customer success to harness the data and orchestrate activation and expansion.

Customer Success

The post-sales customer journey will be integral to growth and expansion in a usage-based pricing model. “The role of CS is now elevated and more analytical,” said Goldenberg, “How you figure out which customers to nurture, support, onboard, guide towards the right level of usage, turns CS towards a very data-driven function and a vector for growth.”

Sales

Sales reps have to be both more technical and business value / customer-success minded than they’ve historically been. Closeness to customer success is key, with upsell and cross-sell activity potentially sitting in either camp. Regardless, sales and customer success need a seamless internal partnership to ensure product adoption and expansion.

Product Teams

Product teams are used to building new features that sales can then sell for additional revenue. But in this model, they switch to a mindset of perfecting ease-of-use. Go-to-market positions the value and then product teams must ensure users experience that perceived value rather quickly.

In product-led growth, product teams must enable customer onboarding that requires little need for support. The entire mindset switches from taking clients from A to B in a sales cycle—to taking them from A to B in their success. Product teams must be aware of how the product is being consumed and be experimental in looking at ways to reduce friction so that customers can use the product more often. That way, product teams go from just building new features to driving revenue growth at a company.

Usage-based pricing drives RevOps roles

A tangential trend occurring alongside the shift to usage-based pricing models is the increasing popularity of the revenue operations (RevOps) role.

“Executives and CEOs need somebody that can look at all revenue contributions and the data that runs across each part of the customer journey, to create that single source of truth,” explained Winch.

Much like the role of customer success became a must-have for subscription-based software businesses last decade, RevOps roles are rising globally, particularly in Europe, which typically lags North America trends by a few quarters.

“The challenge for the RevOps role is that the amount of talent that exists right now is still being developed, so supply and demand aren’t in sync,” said Haggerty. “Companies need to learn what RevOps is and the talent for the roles needs to be developed. We’ve seen lateral hires coming from areas such as sales ops who are not overly siloed and have had exposure to broader go-to-market functions,” he added.

——

True has extensive experience helping product-led growth, usage-based pricing companies build their leadership teams across all asset classes and product categories. To connect with the Enterprise practice for more information, or to discuss a mapping project or an executive search, please contact: Pat Haggerty pat@truesearch.com and David Winch david.winch@truesearch.com.