Hydrogen: The Surprise of the Decade

The hydrogen economy is in an acceleration phase, evolving rapidly with each investment within the private and public sectors driven by global demand. Over the last decade, we have seen costs significantly decrease for solar, wind and battery technologies; green hydrogen is being set up to take a similar fast track to large-scale commercialization.

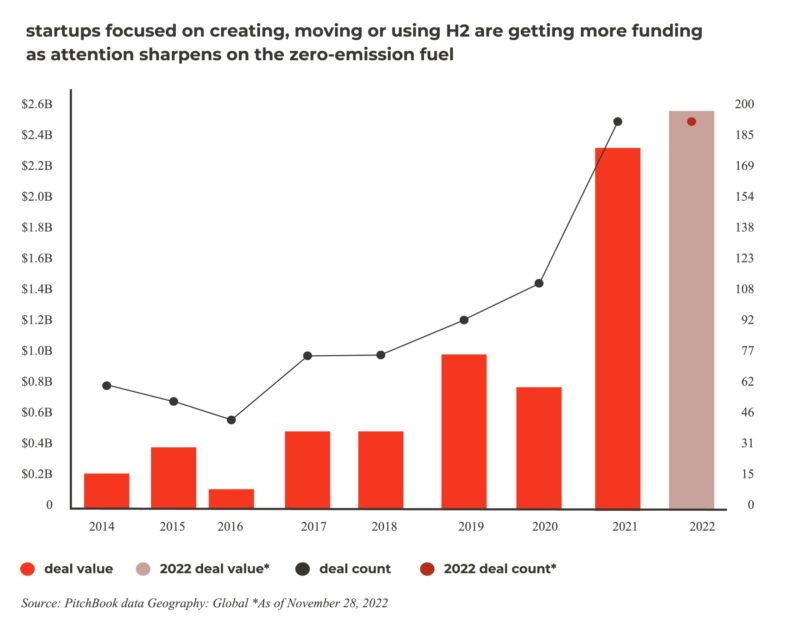

Since 2014, the number of annual VC hydrogen deals has more than tripled as PE deal count quadrupled. In 2021, venture capital activity in hydrogen totaled almost €2 billion (Deloitte, 2022). The following year, VC and PE firms deployed more capital into global companies: making, moving or using more hydrogen—or planning to—than any year prior (Pitchbook, 2022). During 2022, venture firms invested $2.6 billion in 192 startups and PE firms spent $3.1 billion on hydrogen-related companies across 37 deals. This trajectory is something we have seen at True with increased activity within the hydrogen sector.

Hydrogen’s Takeoff

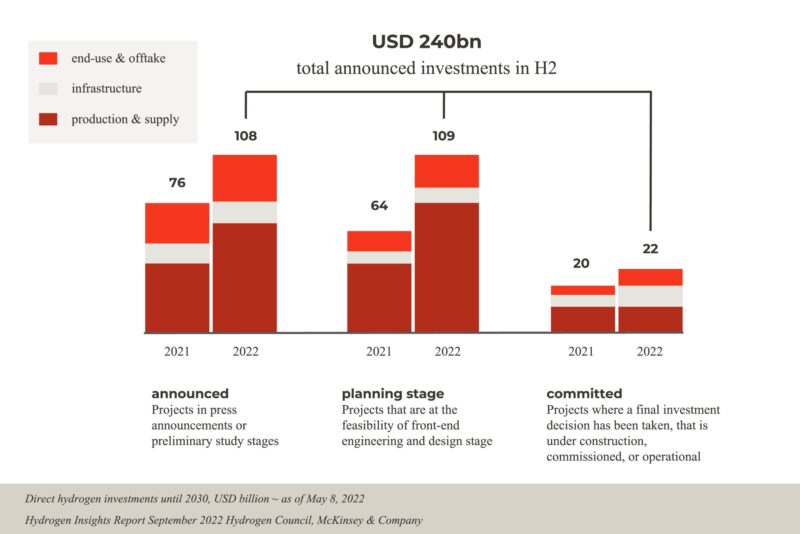

Hydrogen’s takeoff in the private markets comes in the wake of governmental and corporate commitments in Europe, Asia and North America to build hydrogen infrastructure. These commitments have been hastened by the war in Ukraine and the drive to decrease the EU’s dependency on natural gas from Russia. In the Netherlands, for example, the government recently announced that it allocated €750 million to repurpose parts of its extensive natural gas pipeline network to hydrogen and another €35 million to hydrogen storage.

The EU also recently announced the creation of a new European Hydrogen Bank that will invest €3 billion to build a market for hydrogen. Commission President Ursula von der Leyen, stated, “We need to move our hydrogen economy from niche to scale.” Across the globe, investors and governments are coming together to finance and capitalize on what has been dubbed the ‘clean’ hydrogen revolution—more than 30 countries have already released official hydrogen strategies and roadmaps outlining consumption trends and infrastructure plans.

In 2021, invested capital nearly tripled, driven by strong growth in early-stage VC deals. There were several large, early-stage deals: Lhyfe raised €50 million in September; Universal Hydrogen raised €53 million in October; FTXT Energy Technology raised €125 million and EnerVenue raised €110 million in December. Following a record 2021, investment continued to increase. 2022 saw some of the largest VC rounds, such as Monolith, the world’s largest producer of clean hydrogen, which raised $300 million in its Series D round led by TPG and Decarbonization Partners, the latter being a JV between Temasek and BlackRock. In addition, Sunfire and Electric Hydrogen raised £225 million and £155 million, respectively.

Breadth of Investors

It was not just VC or PE firms that contributed to that rise, Corporate Venture Capital (CVC) businesses also played their part. Three of the top five CVCs investing in the H2 market were Shell, Air Liquide and Hyundai. Further, the wider renewables market and ABB Technology Ventures closed ten deals, investing more than $100 million in 2022 alone, including participating in the massive $1.1 billion financing round for Swedish battery manufacturer Northvolt AB.

The venture activities of CVCs have been diverse, but also strategic and targeted, creating the potential for synergies and knowledge sharing as they position themselves across the H2 value chain.

Robert Bosch acquired a 13% stake in the stationary fuel cell company Powercell Sweden in 2019 and a 14% stake in the Solid Oxide Fuelcell (SOFC) company Ceres Power in 2020.

As an investment, hydrogen can be allocated across the portfolio, from PE/VC investments in fuel cell technology, for example, through to infrastructure plays in storage hubs and refueling stations. The fuel cell market alone is projected to grow from $3.36 billion in 2021 to $28.95 billion in 2028, at a compound annual growth rate (CAGR) of 36% over the period. Hy24, a joint venture between FiveT Hydrogen and Ardian, has announced the closing of €2 billion Clean H2 Infra Fund focused on scaling proven hydrogen technologies for mature infrastructure assets.

With investors pouring in capital to develop a more mature market, different players across the value chain are collaborating through M&A or joint ventures to increase their technological know-how, build scale and improve their competitive positioning. Joint Ventures or Strategic Alliances are playing a key role in advancing the sector and de-risking the investment. For example, NortH2 is a consortium consisting of Shell, Equinor, RWEand Eneco, aimed at developing one of Europe’s largest green hydrogen projects.

The demand for hydrogen will continue to grow, as it plays a pivotal role in the goal to Net-Zero. That said, expected VC and PE investing over the next few years will likely further solidify hydrogen as the surprise of the investment landscape.

True Search

True Search, is North America’s sixth-largest executive search firm, and global leader in VC-backed startups. With more than twenty years of experience within disruptive climate technologies, including a deep track record in hydrogen (many included in this report), True is well-positioned to support investors and portfolio companies alike with Executive and Board hires at the forefront of hydrogen’s coming of age.

Additional resources: Pitchbook (2022), Deloitte (2022), McKinsey Report (2022)