A look at what’s drawing executives from outside Healthcare and EdTech into those industries

Dan Levin wasn’t on the path to become an EdTech executive. He made his mark in Silicon Valley at Box, taking the cloud content management and file sharing service from $10 to $500 million in his seven years as COO. Before that he held senior roles at Intuit and Quickbooks Group.

So how did Dan wind up as CEO of Degreed, the enterprise EdTech upskilling software company that raised $153 million in Series D funding at a $1.4 billion valuation?

It was the company’s mission: promoting and enabling lifelong learning. As a dedicated mentor to CEOs at other high-growth companies, Dan was hooked.

“Dan is somebody who’s been incredibly successful. He gets calls all the time,” recalled Matt Engel, True partner and EdTech practice lead. “But this opportunity really resonated with him because he’s all about developing people.”

Levin is just one of many executives taking their skills from outside industries into EdTech. This talent trend of “outside-in executives” has accelerated in EdTech, and has been mirrored in the similarly mission-driven field of healthcare.

The leadership in True Healthcare and EdTech practices identified this trend of outside-in placements and drilled down into what it means for investors, businesses and executives in this space. What type of person is successful at transitioning into these industries and what attracts them in?

Who are these outside-in executives?

True’s strength is rooted in the ability to place innovative technology-forward executives in high-growth companies. Many of the outside-in placements in EdTech and healthcare are tech-focused, but these executives are not limited to technology roles.

Areas where healthcare and EdTech have successfully pulled executives include engineering, marketing and finance roles among others.

Partner Jacob Sack co-heads True’s Healthcare practice.

“These are executives who love operating in hyper-growth modes and companies that are at inflection points,” Sack said. “But largely, they are execs that have a consumer orientation or are simply best-in-class in their operational function.”

Sack said he’s seen outside-in executives tackle real problems in healthcare by applying the skills they’ve brought from previous roles. Some healthcare challenges are not clinical issues – they’re operational challenges.

“It is an operational challenge to say, ‘how do we reach a person in their home before they end up in the emergency room?’” Sack said. “We have the predictive data to say when something might happen. We have the ability to be more proactive and preventive. These types of problems that need outside solutions are happening across healthcare.”

One executive that brought innovative solutions to an old healthcare problem was CEO David Stavens. Before founding the teleradiology company Nines, Stavens was a NASA computer scientist, the co-founder of the self-driving car team that became Google Waymo, and co-founder and CEO of the digital learning platform Udacity.

Nines works to democratize access and increase efficiency of reads in the radiology business. The company provides AI and machine learning technology that empowers radiologists to read people’s medical scans more accurately and from anywhere. (True Equity has also invested in Nines.)

It is also clear that while industries may be different, a lot of the business models are the same.

Take the earlier example of Degreed CEO Dan Levin. He appeared to have made a dramatic career shift, but when you peel back the layers, Degreed was fundamentally an enterprise SaaS business (an area where he has a ton of expertise).

However, outside-in executives are not a panacea. Companies – healthcare and EdTech alike – still very much need talent with industry expertise.

There are aspects of the EdTech market in particular where roles demand previous industry experience. For example, an executive selling into the K-12 market or the Higher Ed market needs deep knowledge of that unique vertical to be successful. The nuances abound – capitalizing on buying seasons, navigating bureaucracy, and understanding and managing long-term relationships. The earlier the stage of the company, the more critical experience is to understand the product-market fit.

In general, the more a business is at scale and scaling in EdTech, the less important that deep domain expertise is for market-facing roles (CEO, marketing, sales, customer success).

Take for example, Raptor Technologies, which provides school safety technologies for K-12 schools. True placed CEO Gray Hall into the business from his previous role as chairman and CEO of Alert Logic, a cyber security company.

“Raptor was not focused on whether the CEO candidate had domain expertise because at that point, there was plenty of K-12 experience already in the company,” Engel said. “They needed someone who knew how to scale a business.”

It can be tough to know when an outside-in executive will truly be additive to the business and it often takes knowledgeable counsel to make that determination.

“We’re experts in understanding people skills and where they can project and do well at a certain growth-phase of a company,” Engel said.

Mission-Driven – and Ripe for Innovation

A primary motivator for executives switching industries is attraction to the mission. In fact, few industries are more mission-motivated than healthcare and EdTech. So why is the mission more attractive and essential right now?

Here’s another place where the pandemic is pivotal. The worldwide quarantine instantly revealed the shortcomings of both healthcare and education. For many, company missions became personal as people witnessed first-hand the challenges of remote learning.

“Lots of these executives are parents – and whether their kid was in early childhood, K-12 or Higher Ed – they literally watched the struggle in front of them,” Engel said. “The younger the kid, the more they lived it as quasi-teachers.”

That struggle highlighted the opportunities for innovation for would-be EdTech executives.

“When COVID hit, 70% of the K-12 curriculum was still in print,”said Helen Resor, Principal in True’s EdTech practice.

That had to change overnight as students at all levels were forced into remote learning. UNESCO data estimates that nearly 1.6 billion learners, approximately 94% of the world’s student population, were impacted when schools closed at the peak of the crisis.

“We can’t do things on pen and paper anymore,” Resor said. “We can’t go back. Companies recognized immediately they needed to adjust quickly.”

The pandemic accelerated change in early childhood education, K-12 and higher education – but the real momentum was in enterprise and consumer parts of EdTech. Trends that were already underway accelerated.

“Upskilling,” became huge as companies needed innovative technologies to be able to train their workforce remotely and provide more continuous and lifelong learning. One such upskilling company, Go1, has promised to match “diverse workforce training needs” with their digital learning library offering over 100,000 resources to “overcome the challenges of tomorrow.” Their VP of Sales John Amici joined the EdTech company from WeWork with a background outside of EdTech.

More people started using the technology from companies with the mission of democratizing knowledge and teaching all learners – outside of the confines of traditional schooling. An example of such a business is Outlier.org. The business aims to increase access to college educations and reduce student debt with low cost online courses and credits that more easily transfer to other in-person universities.

Companies that previously touted these missions were better equipped to make the case for how that was necessary and viable in this moment.

“There are more sophisticated use cases for the technology, there are new go-to-market motions, and EdTech is experiencing a growth curve like we haven’t seen before,” said Resor. “Because of those things, it is forcing recruiters to look outside of the space to find someone who has that different go-to-market motion or someone who has seen these use cases in other verticals.”

That same digital transformation happened in healthcare too.

The waiting rooms, paper records and fax machines revealed themselves for the outdated relics they were when they became useless to everyone stuck at home.

Doctors that would have never considered virtual visits – had to make them reality.

That led to an enormous growth in virtual care. McKinsey and Company reported health systems, primary care, and behavioral health practices experienced increases of more than 50–175 times in telehealth visits, and the potential market size for virtual care could reach around $250 billion.

Jacob Sack said the future of healthcare has already proven to be for the innovators willing to treat people as both patients and consumers of their health.

“We are consumers who can get approved for a mortgage and buy a house with a couple clicks on an app, and yet we can’t send a thank-you text to a doctor who saves our life,” Sack said.

Innovative companies realized that had to change.

Disrupting the Old Guard – the Time is Now

Mission is key. Innovation is necessary and now change is actually happening. This impact in EdTech and healthcare is real and it’s fueling movement that’s attractive to the outside-in executive.

“I don’t think it’s hyperbole to say this: I think a reckoning is coming in U.S. healthcare,” Sack said. “The lack of alignment between cost, quality and outcomes, in addition to the lack of transparency about what it actually means to be a patient or consumer within the U.S. healthcare system. It is getting tested.”

Sack points to companies like TigerConnect, for how they challenged the old way of communicating — across care teams in the provider setting and with patients — and brought it into the modern age. They built a communication platform that allows for secure exchange of text, video, and voice messages. True helped find their Chief Technology Officer Tim Goodwin and Chief Marketing Officer Wendy White. Goodwin came from Fiserv and Vacasa while White came in from Motorola, Microsoft, CenturyLink and Expedia.

True also worked with SimpleHealth to find CEO Carrie Siubutt. She came from Amex, Equinox and Row House to passionately lead a healthcare company democratizing access to birth control by providing online prescriptions and free at home delivery.

“The headline that’s not being shared, because it’s a little provocative, is that traditional healthcare systems and hospitals probably wouldn’t be thrilled with the conversations that are happening in the venture boardrooms about putting billions of dollars in the companies designed to disrupt the system,” Sack said.

This is also the moment because the capital is available and the policy and legislation is friendly to telehealth and practicing across state lines. Healthcare and hospitals have typically lagged behind in innovation and been hesitant to change because of privacy concerns, regulation, safety concerns and other constraints. But again, the pandemic has forced their hand on so many of these issues and proven the value of these companies’ solutions.

“There’s a recognition that this is a moment in time for someone who has spent a career doing great work and now they can actually apply that knowledge in a hyper-growth setting“ Sack said.

Investment, Unicorns And Big Exits Have Arrived

And last, but certainly not least, is the fact that heavy investments are being made in both healthcare and EdTech, which are attractive to outside executives.

Rock Health reported that $6.7 billion dollars was invested into digital healthcare in Q1 of 2021. Deals are getting bigger with an average size of $45.9 million so far in 2021 compared to $31.7 million average in 2020.

In 2020, digital health saw exits of seven “unicorn companies,” or private companies valued at more than one billion. That was a notable increase over the four exits in 2019 and two in 2018, according to CB Insights. SPACs also offered new exit pathways with 10 happening in Q1. (Rock Health). CB Insights anticipated more healthcare unicorn exits in the near term because 67% of the current healthcare unicorns are late stage and SPAC Track has identified around 53 SPACs actively searching for target companies across the healthcare and life sciences industries.

McKinsey and Company reported that technology-driven innovation in healthcare may create from $350 billion to $410 billion in annual value by 2025.

“From a sheer business standpoint, not only is healthcare 17, almost 18 percent of GDP(2019), but there’s a record level of investment right now,” Sack said. “There is a ton of money pouring in.”

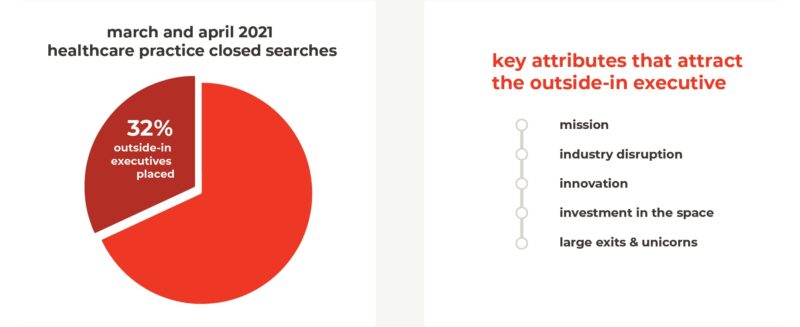

That investment translates into unprecedented demand for talent and new ideas to carry these companies forward. The True Healthcare practice closed 18 searches in March 2021 and then increased that to 29 closes in April 2021. And ⅓ of those executives placed in April and March were from industries outside healthcare. Compare those numbers to the 12 closes in March of 2020 and it’s a clear increase in demand – and opportunity for people looking to move into healthcare.

The same investment has been flowing into EdTech too and making that career switch more attractive.

“The amount of capital going into EdTech, even pre-2020, was high.” Engel said. “Since Covid, the amount of money going in has just ballooned. Now, we have to figure out which one of these businesses have benefited from Covid and whether there was a Covid bump or long term impact.”

Holon IQ reported $4 billion of venture funding raised worldwide in the first 12 weeks of 2021. The US deployed $1 billion in Q1, which already challenges 2020’s record of $2.5B of EdTech VC.

GSV Ventures predicts digital learning will reach 11% of the education market by 2026, representing an almost $1 trillion market and a 30% CAGR.

EdTech companies are also experiencing very large exits – in a way that wasn’t happening before.

Coursera went public in April 2021 making it an EdTech unicorn. Trading after their IPO had pushed the online learning company’s valuation past $7 billion. Digital-learning platform Clever was acquired by True client Kahoot!, the game-based learning company, for up to $500 million dollars.

“Think about the factors: mission-driven, additional investment into the space, therefore there are more companies,” Engel said. “But also what’s happening is you’re starting to see very, very large exits for these businesses. Now people look at these and say, ‘oh, you can make a lot of money. You can have big exits with EdTech.’”

Generalist investors and more executives have taken interest as they see more EdTech companies go public and get unicorn status for the first time.

Degreed, Masterclass, Outschool, Duolingo, CourseHero and others make 25 private companies with a valuation over $1 billion USD as of May 2021.

“Healthcare and EdTech have always attracted mission-driven people – always, always, always,” Engel said. “People stayed away because the industries were archaic and a pain to change. Now they have seen the money flowing into the market, companies beginning to be successful disrupting them, and having big outcomes. Those are the real drivers as to why you’re not only getting mission-driven people, which they have to be, but also you’re getting folks who have skill sets more broad than EdTech and healthcare.”